This post is about credit default swap. Though CDS is not familiar, CDS can be used to protect from credit risk and market risk. If you heavily invest on foreign currency based bond for long term, and the bond has default risk, CDS is absoultely what you are looking for.

What is Market risk

Market risk includes risk derived from interest rate, foreign currency exchnage rate fluctuation. These factors are mainly discussed in macro ecnoomy market. Forward Rate Agreement, Interest Rate Swap, and Cross Currency Swap are examples of financial instruments intened to protect from macro economic variable.

Whart is Credit risk

If you just invest in US treasury or treasury of soverign country and wriiten in local currency, you don’t have to deal with credit risk. But, if you want to invest in corporate bond or sovereign bond of emerging country, you need to worry about default risk. CDS is the instrument to mitigate credit risk when default happens.

What is Credit Default Swap

CDS is an insurance contract, which you can receice payment when default happens. Suppose you are portfolio manager at Korea, you want to invest emerging bond in US with USDollar. What you need to worry about is default of company or country and fluctuation of interest rate. Supoose you are investing on corporate bond in US, you need to worry about default of company too. Before CDS there was no adequate method to mitigate credit risk only, since corporate bond rate is sum of market risk and credit risk.

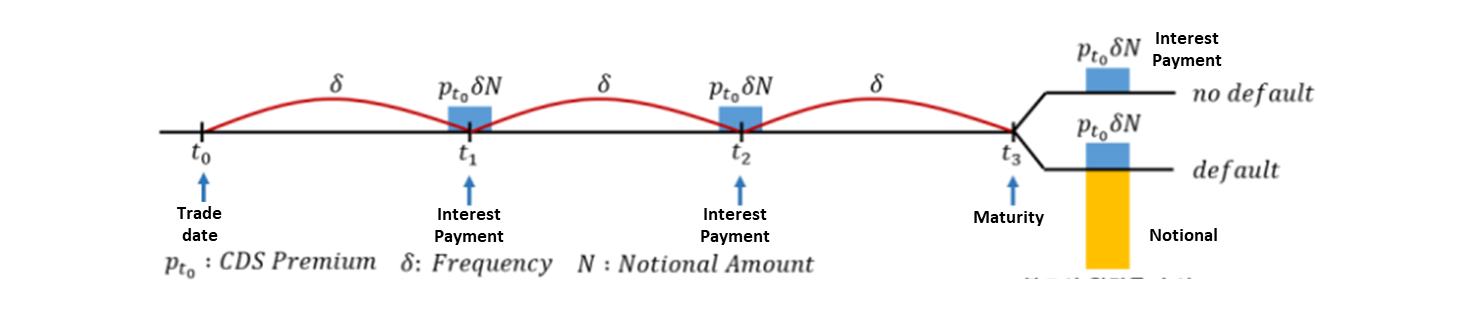

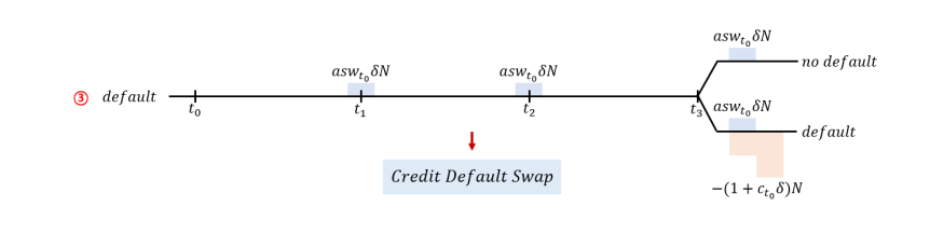

Cashflow of CDS seller, who receive premium for giving protection to buyer, is like below. He/She receive fixed CDS premium at interest payement date. If default does not happens, CDS seller just receive premiums only. If default happens, CDS seller pays notional amount and receive impaired underlying asset. Since impaired asset, which is usually corporate bond, can recover after default, we need to consider recovery rate. However, this number vary by industry and it is determined by accountants and lawyers. So, in here we set recovery rate to zero.

From corporate bond to CDS

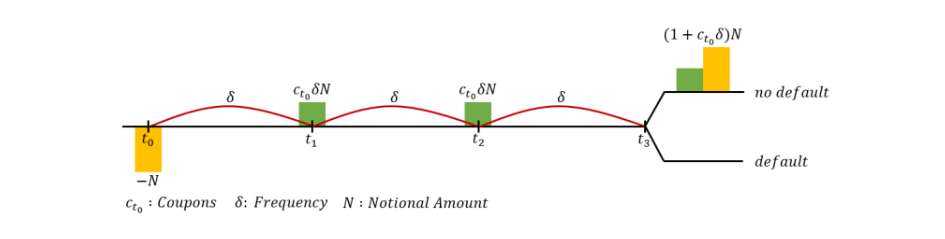

Below picture shows typical cashflow from corporate bond.

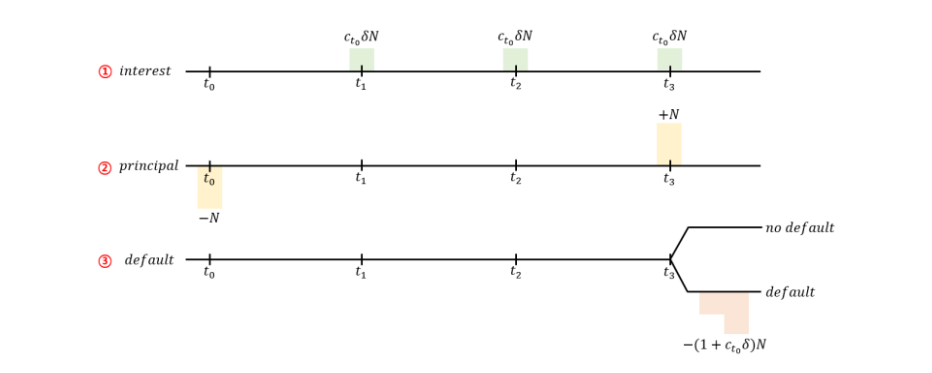

Cashflow of corporate bond can be decomposed into interest, principal and payment at default.

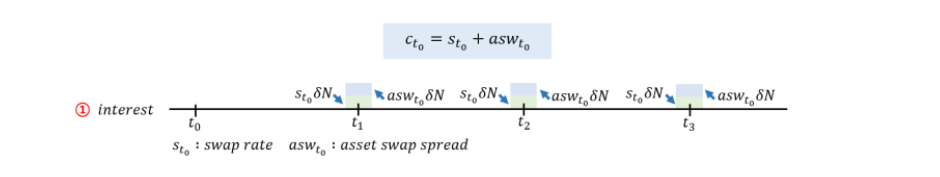

We divide interest part to market risk and credit risk. And “asset swap spread” can be declared like this. $ Asset Swap Spread = CorporateBondYield - SwapSpread $. Using this, corporate bond interest can be decomposed like this.

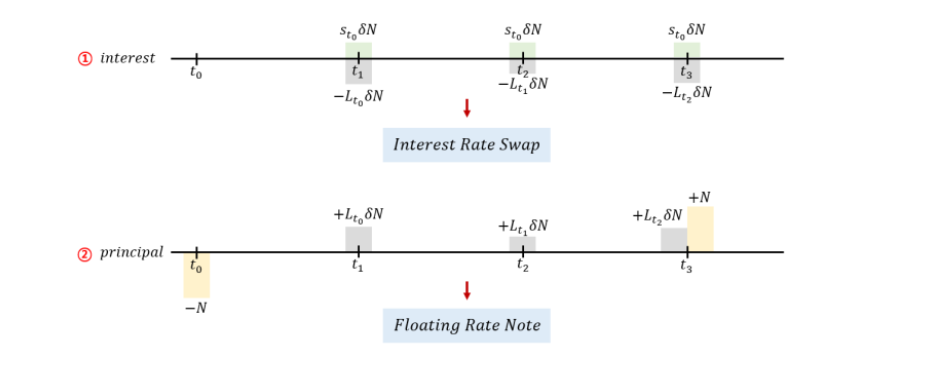

Now, we change interest part and principal part into Interest Rate Swap and Floating rate bond investmebt.

In here, we add Asset Swap Spread(represent credit risk of corporate bond) to default part like below.

Buyer and seller of credit default swap (CDS)

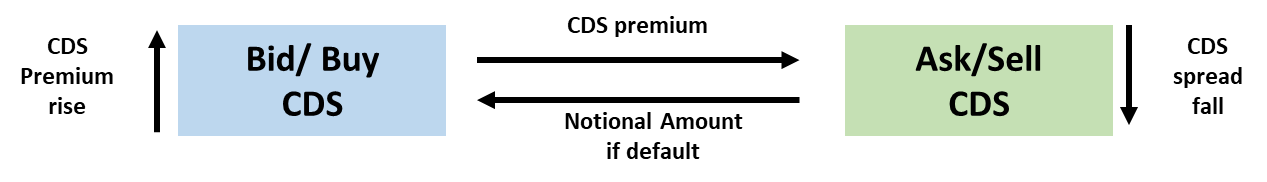

Bid CDS (Protection Buy) = Sell corporate bond + Receive Interest Rate Swap + Buy Floating Rate Note

Ask CDS (Protection Sell) = Buy corporate bond + Pay Interest Rate Swap + Buy Floating Rate Note

Summary

See below picture, if you are facing trouble in memorizing the CDS structure.

Prequisite

You need two curve to price CDS. Since it is long-term contract with underlying asset of bond, discount curve is needed. In here, swap_curve function is to discount future cash flow. In addition, you need to calculate harzard rate since it has possibility of default. In here, cds_curve function is to discount expected cashflow at maturity considering default probability.

1

from quant_lib.cds_curve import get_irs_quote, get_cds_quote, swap_curve, cds_curve

If you don’t want to make your own swap curve library, go to this link and download and place it appripriate directory. CDS_Curve_Code

Data for this project can be found here.

CDS_Data

Result

Let’s price credit default swap

1

2

3

4

price of CDS = 964810.2233

IR Delta = -236.2413

Credit Delta = -2693.3063

Theta = 75.4122

Let’s code this idea

Full code can be found at below link.

CODE

Full Code

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

import os

import datetime

import numpy as np

import pandas as pd

import QuantLib as ql

from quant_lib.cds_curve import get_irs_quote, get_cds_quote, swap_curve, cds_curve

class CDS():

def __init__(self, today, maturity_date, spread, recovery, notional, position):

# initial setup

self.date = today

self.discount_curve_t0 = self.discount_curve(self.date)

self.cds_curve_t0 = self.cds_curve(self.date)

self.maturity_date = ql.Date(maturity_date.day, maturity_date.month, maturity_date.year)

if position == 'long':

self.position = ql.Protection.Buyer

else:

self.position = ql.Protection.Seller

self.spread = spread

self.notional = notional

self.recovery_rate = recovery

self.tenor = ql.Period(3, ql.Months)

self.calendar = ql.UnitedStates()

self.convention = ql.ModifiedFollowing

self.dateGeneration = ql.DateGeneration.CDS

self.dayCount = ql.Actual360()

self.endOfMonth = False

# pricing result

self.npv = self.pricing(self.discount_curve_t0, self.cds_curve_t0)

self.ir_delta = self.ir_delta()

self.credit_delta = self.credit_delta()

self.theta = self.theta()

def discount_curve(self, date):

return swap_curve(date, get_irs_quote(date))

def cds_curve(self, date):

return cds_curve(date, get_cds_quote(date), swap_curve(date, get_irs_quote(date)))

def pricing(self, discount_curve, cds_curve):

# processing

todays_date = ql.Date(self.date.day, self.date.month, self.date.year)

discount_curve_handle = ql.YieldTermStructureHandle(discount_curve)

schedule = ql.Schedule(todays_date,

self.maturity_date,

self.tenor,

self.calendar,

self.convention,

self.convention,

self.dateGeneration,

self.endOfMonth

)

cds = ql.CreditDefaultSwap(self.position,

self.notional,

self.spread/1000,

schedule,

self.convention,

self.dayCount

)

probability = ql.DefaultProbabilityTermStructureHandle(cds_curve)

engine = ql.MidPointCdsEngine(probability=probability,

recoveryRate=self.recovery_rate,

discountCurve=discount_curve_handle

)

cds.setPricingEngine(engine)

npv = cds.NPV()

return npv

def ir_delta(self):

curve_handle = ql.YieldTermStructureHandle(self.discount_curve_t0)

# 1bp

basis_point = 0.0001

# CDS price when 1bp up

up_curve = ql.ZeroSpreadedTermStructure(curve_handle, ql.QuoteHandle(ql.SimpleQuote(basis_point)))

up_cds = self.pricing(up_curve, self.cds_curve_t0)

# CDS price when 1bp down

down_curve = ql.ZeroSpreadedTermStructure(curve_handle, ql.QuoteHandle(ql.SimpleQuote(-basis_point)))

down_cds = self.pricing(down_curve, self.cds_curve_t0)

# interest rate delta

return (up_cds - down_cds) / 2

def credit_delta(self):

_cds_quote = get_cds_quote(self.date)

# CDS price when 1bp up

_cds_quote['Market.Mid'] += 1

up_curve = cds_curve(self.date, _cds_quote, self.discount_curve_t0)

up_cds = self.pricing(self.discount_curve_t0, up_curve)

# CDS price when 1bp down

_cds_quote['Market.Mid'] -= 1

down_curve = cds_curve(self.date, _cds_quote, self.discount_curve_t0)

down_cds = self.pricing(self.discount_curve_t0, down_curve)

# credit delta

return (up_cds - down_cds) / 2

def theta(self):

price_t0 = self.pricing(self.discount_curve_t0, self.cds_curve_t0)

discount_curve_t1 = self.discount_curve(self.date + datetime.timedelta(days=1))

cds_curve_t1 = self.cds_curve(self.date + datetime.timedelta(days=1))

price_t1 = self.pricing(discount_curve=discount_curve_t1, cds_curve=cds_curve_t1)

theta = price_t1 - price_t0

return theta

## build CDS contract information

todays_date = datetime.date(2020, 12, 11)

maturity_date = datetime.date(2025, 12, 11)

notional = 10000000

spread = 20.5241

recovery = 0.4

position = 'short'

# build CDS object

cds = CDS(

today=todays_date,

maturity_date=maturity_date,

spread=spread,

recovery=0.4,

notional=notional,

position=position

)

# Print result

print("price of CDS = {}".format(round(cds.npv,4)))

print("IR Delta = {}".format(round(cds.ir_delta,4)))

print("Credit Delta = {}".format(round(cds.credit_delta,4)))

print("Theta = {}".format(round(cds.theta,4)))