This post is about cross currency swap. Though CCS is not familiar, IRS can offer interest rate risk - currency rate risk mitigation. If you heavily invest on foreign currency based asset classes for long term, CCS is absoultely what you are looking for.

What is Cross Currency Swap

Suppose you are portfolio manager at Korea, you want to invest certain asset in US with USDollar. Some might think FX swap as a solution to mitigate currency risk since FX swap combines spot and forward agreement. However, typical FX swap contracts have maturity under 1 year. So, if use forward aggrement in rolling manner, you cannot mitigate risk completely.

Cross Currency Swap is used in this situation. CCS is OTC contract which participants exchange interest of each currency to use foreing currency. For example, one pay KRW interest to use KRW currency loan and the others pay USD interest to use USD loan. Typically, notional amount (loan amount) is exchanged at the beginning of contract with spot exchange rate.

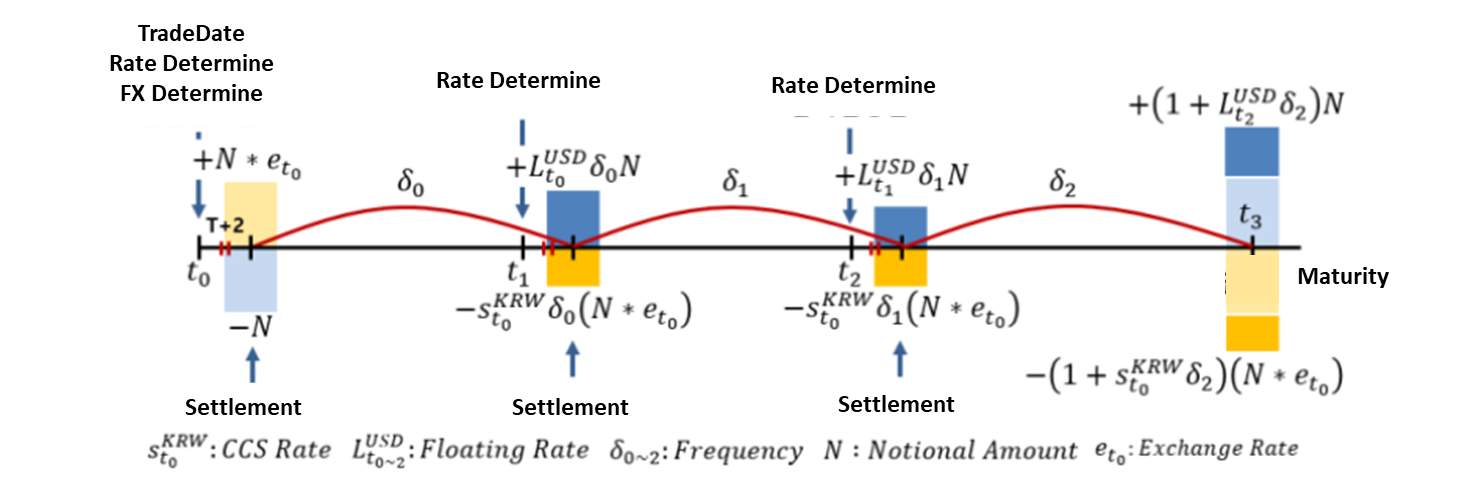

Typically, every 6 month, interest are payed. And participants who have KRW & use USD pays fixed interest and the other participant who have USD & use KRW pays floating interest to others. See below image to help your understanding.

How to valuate Cross Currency Swap

Swap can be caluclated by summing present value of expected cashflows. Since interest rate of each currency is different, we need to build two individual interest rate swap curve for each currency. Equation is like below.

$CCS Swap Value = {Receive} - {Pay}$

where,

$Receive = N \times e_{t_0} \times [1-\frac{1}{({1+z_{t_n}}^{KRW})^{t_n}} + \sum_{i=1}^{n} \frac{{s_{t_0}}^{KRW} \delta_{i-1}}{({1+z_{t_i}}^{KRW})^{t_i}}] $ $Pay = N \times [1-\frac{1}{(1+z_{t_n}^{USD})^{t_n}} - \sum_{i=1}^{n} \frac{L_{t_{i-1}}^{USD} \delta_{i-1}}{(1+z_{t_i}^{USD})^{t_i}}]$

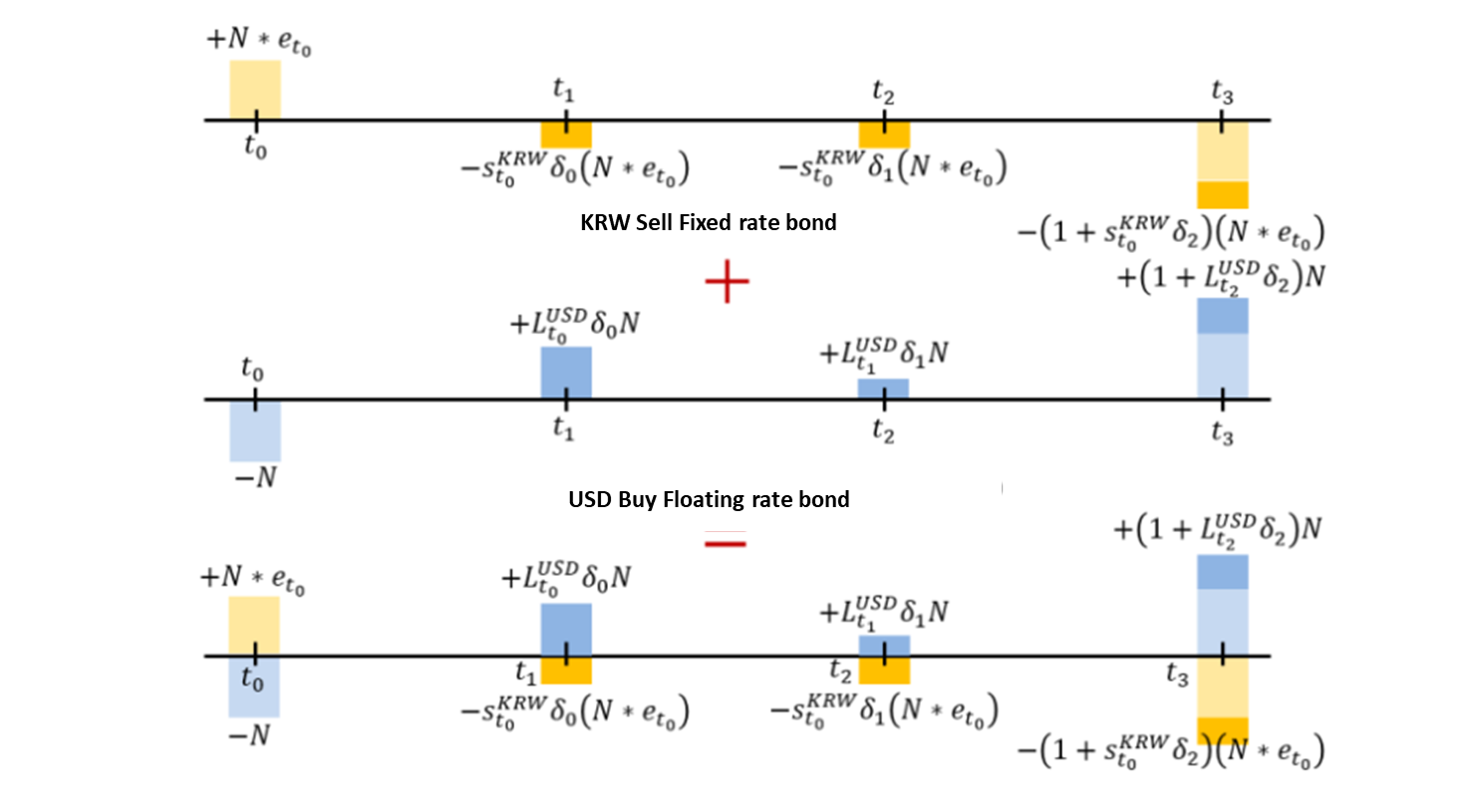

Below picture gives you what really consists of CCS. CCS decomposition helps you to understand how above frightening equation is derived from.

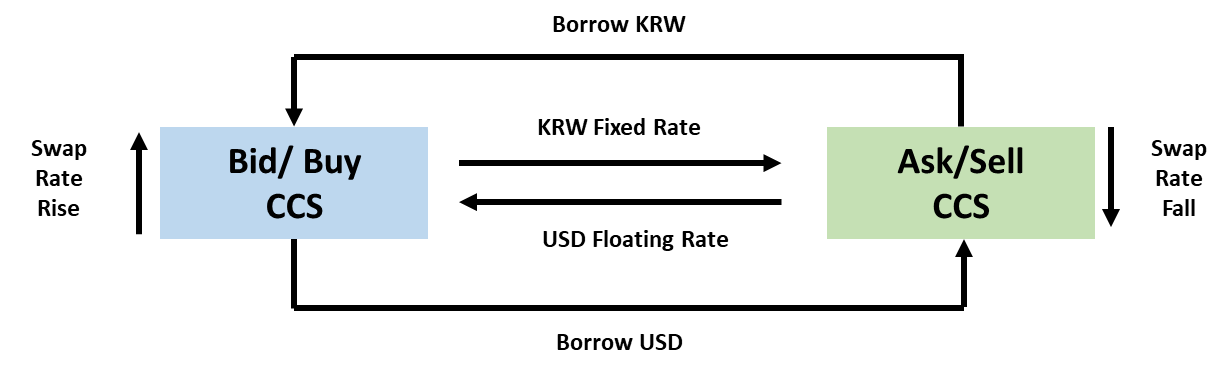

Buyer and seller of cross currency swap (CCS)

Bid CCS (CCS pay) = expect exchage rate rise, KRW interest rate rise, USD interest rate fall

Ask CCS (CCS receive) = expect exchange rate fall, KRW interest rate fall, USD interest rate fall

Summary

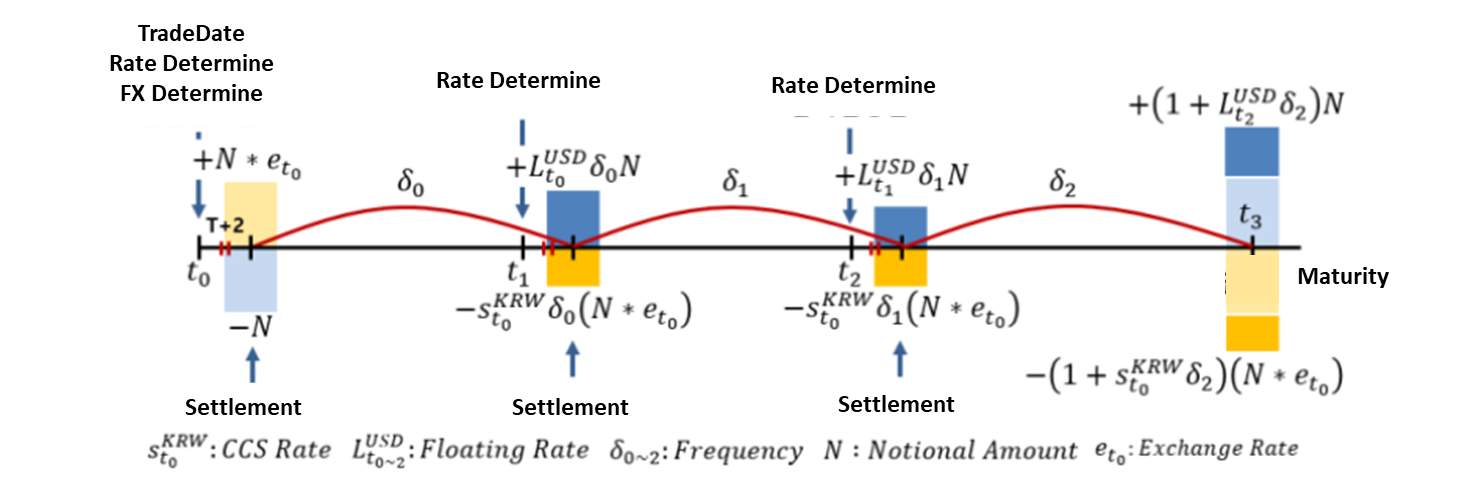

See below picture, if you are facing trouble in memorizing the CCS structure.

Prequisite 1

1

2

pip install QuantLib==1.18

pip install QuantExt-Python==1.8.3.3.5

We use extended QuantLib package. So, you need to install stated version to calculate CCS.

Since original quantlib cannot incorporate multiple curve, which is essential for cross currency products, We have to use extended QuantLib package. Please follow above code.

Prequisite 2

1

from quant_lib.fx_swap_curve import get_quote, usdirs_curve, krwccs_curve

If you don’t want to make your own swap curve library, go to this link and download and place it appripriate directory.

FX_Swap_Curve_Code

Result

Let’s price cross currency swap

1

2

3

4

5

price of FXF = 19914.3747

FX Delta = -4296.0136

USD IR Delta = -6301.2805

KRW IR Delta = 4523955.1303

Theta = -23596.1045

Let’s code this idea

Full code can be found at below link.

CODE

Full Code

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

185

186

187

188

189

190

191

192

193

194

195

196

197

198

199

200

201

202

203

204

205

206

207

208

209

210

211

212

213

214

215

216

217

218

219

220

221

222

import os

import datetime

import numpy as np

import pandas as pd

import QuantExt as qe

from quant_lib.fx_swap_curve import get_quote, usdirs_curve, krwccs_curve

class CCS():

def __init__(self, today, effective_date, maturity_date, ccs_rate, fx_spot, usd_notional, position):

# initial setup

self.date = today

self.usd_curve = self.usd_curve(self.date)

self.krw_curve = self.krw_curve(self.date)

self.fx_spot = fx_spot

self.effective_date = qe.Date(effective_date.day, effective_date.month, effective_date.year)

self.maturity_date = qe.Date(maturity_date.day, maturity_date.month, maturity_date.year)

self.ccs_rate = ccs_rate

self.usd = qe.KRWCurrency()

self.krw = qe.USDCurrency()

self.usd_notional = usd_notional

self.krw_notional = usd_notional * fx_spot

self.day_count = qe.ActualActual()

if position == 'long':

self.position = qe.VanillaSwap.Payer

else:

self.position = qe.VanillaSwap.Receiver

self.length = 2

self.spread = 0.0

self.convention = qe.ModifiedFollowing

self.calendar = qe.JointCalendar(qe.SouthKorea(), qe.UnitedStates())

self.tenor = qe.Period(6, qe.Months)

self.fixed_day_count = qe.Actual365Fixed()

self.float_day_count = qe.Actual360()

self.dateGeneration = qe.DateGeneration.Backward()

# pricing result

self.npv = self.PRICING(self.usd_curve, self.krw_curve, self.fx_spot)

self.fx_delta = self.FX_DELTA()

self.usd_ir_delta = self.USD_IR_DELTA()

self.krw_ir_delta = self.KRW_IR_DELTA()

self.theta = self.THETA()

def usd_curve(self, date):

return usdirs_curve(date, get_quote(date, 'USD'))

def krw_curve(self, date):

return krwccs_curve(date, get_quote(date, 'KRW'))

def PRICING(self, usd_curve, krw_curve, fx_spot):

# Handles of Market variables

usd_curve_handle = qe.YieldTermStructureHandle(usd_curve)

krw_curve_handle = qe.YieldTermStructureHandle(krw_curve)

fx_spot_handle = qe.QuoteHandle(qe.SimpleQuote(fx_spot))

# Reference Rate

usd_6m_libor = qe.USDLibor(qe.Period(6, qe.Months), usd_curve_handle)

# Fixed Schedule

fixed_schedule = qe.Schedule(self.effective_date,

self.maturity_date,

self.tenor,

self.calendar,

self.convention,

self.convention,

self.dateGeneration,

False

)

float_schedule = qe.Schedule(self.effective_date,

self.maturity_date,

self.tenor,

self.calendar,

self.convention,

self.convention,

self.dateGeneration,

False

)

ccs = qe.CrossCcyFixFloatSwap(self.position,

self.krw_notional,

self.krw,

fixed_schedule,

self.ccs_rate,

self.fixed_day_count,

self.convention,

self.length,

self.calendar,

self.usd_notional,

self.usd,

float_schedule,

usd_6m_libor,

self.spread,

self.convention,

self.length,

self.calendar

)

# Price Engine

engine = qe.CrossCcySwapEngine(self.krw,

krw_curve_handle,

self.usd,

usd_curve_handle,

fx_spot_handle

)

# conduct prcing

ccs.setPricingEngine(engine)

# net present value

npv = ccs.NPV()

return npv

def FX_DELTA(self):

percentage = 0.01

# CCS price when 1% up

up_fx = self.fx_spot * (1 + percentage)

up_ccs = self.PRICING(self.usd_curve, self.krw_curve, up_fx)

# CCS price when 1% down

down_fx = self.fx_spot * (1 - percentage)

down_ccs = self.PRICING(self.usd_curve, self.krw_curve, down_fxf)

return (up_ccs - down_ccs) / 2

def USD_IR_DELTA(self):

# Handle of USD curve

curve_handle = qe.YieldTermStructureHandle(self.usd_curve)

# 1 bp

basis_point = 0.0001

# ccs price when 1bp up

up_curve = qe.ZeroSpreadedTermStructure(curve_handle, qe.QuoteHandle(qe.SimpleQuote(basis_point)))

up_ccs = self.PRICING(up_curve, self.krw_curve, self.fx_spot)

# ccs price when 1bp down

down_curve = qe.ZeroSpreadedTermStructure(curve_handle, qe.QuoteHandle(qe.SimpleQuote(-basis_point)))

down_ccs = self.PRICING(down_curve, self.krw_curve, self.fx_spot)

return (up_ccs - down_ccs) / 2

def KRW_IR_DELTA(self):

# Handle of KRW curve

curve_handle = qe.YieldTermStructureHandle(self.krw_curve)

# 1 bp

basis_point = 0.0001

# ccs price when 1bp up

up_curve = qe.ZeroSpreadedTermStructure(curve_handle, qe.QuoteHandle(qe.SimpleQuote(basis_point)))

up_ccs = self.PRICING(self.usd_curve, up_curve, self.fx_spot)

# ccs price when 1bp down

down_curve = qe.ZeroSpreadedTermStructure(curve_handle, qe.QuoteHandle(qe.SimpleQuote(basis_point)))

down_ccs = self.PRICING(self.usd_curve, down_curve, self.fx_spot)

return (up_ccs - down_ccs) / 2

def THETA(self):

# theta is change in value if one unit time passes.

# in here, unit time is 1 day

# since derivative product have time value, time to maturity is major variable in pricing derivatives

price_t0 = self.PRICING(self.usd_curve, self.krw_curve, self.fx_spot)

# ccsprice at t1

usd_curve_t1 = self.usd_curve(self.date + datetime.datetime(days=1))

krw_curve_t1 = self.krw_curve(self.date + datetime.datetime(days=1))

price_t1 = self.PRICING(usd_curve_t1, krw_curve_t1, self.fx_spot)

return price_t1 - price_t0

## build CCS contract information

todays_date = datetime.date(2020, 10, 8)

effective_date = datetime.date(2021, 11, 1)

maturity_date = datetime.date(2025, 11, 1)

position = 'long'

fx_spot = 1133.85

ccs_rate = 0.002438

usd_notional = 10000000

# build CCS object

ccs = CCS(today=todays_date,

effective_date=effective_date,

maturity_date=maturity_date,

ccs_rate=ccs_rate,

fx_spot=fx_spot,

usd_notional=usd_notional,

position=position

)

# Print result

print("price of FXF = {}".format(round(ccs.npv,4)))

print("FX Delta = {}".format(round(ccs.fx_delta,4)))

print("USD IR Delta = {}".format(round(ccs.usd_ir_delta,4)))

print("KRW IR Delta = {}".format(round(ccs.krw_ir_delta,4)))

print("Theta = {}".format(round(ccs.theta,4)))