This post is about interest rate swap. Though IRS is not familiar, IRS can offer interest rate risk mitigation or chance to seize from interest rate fluctuation.

What is Interest Rate Swap

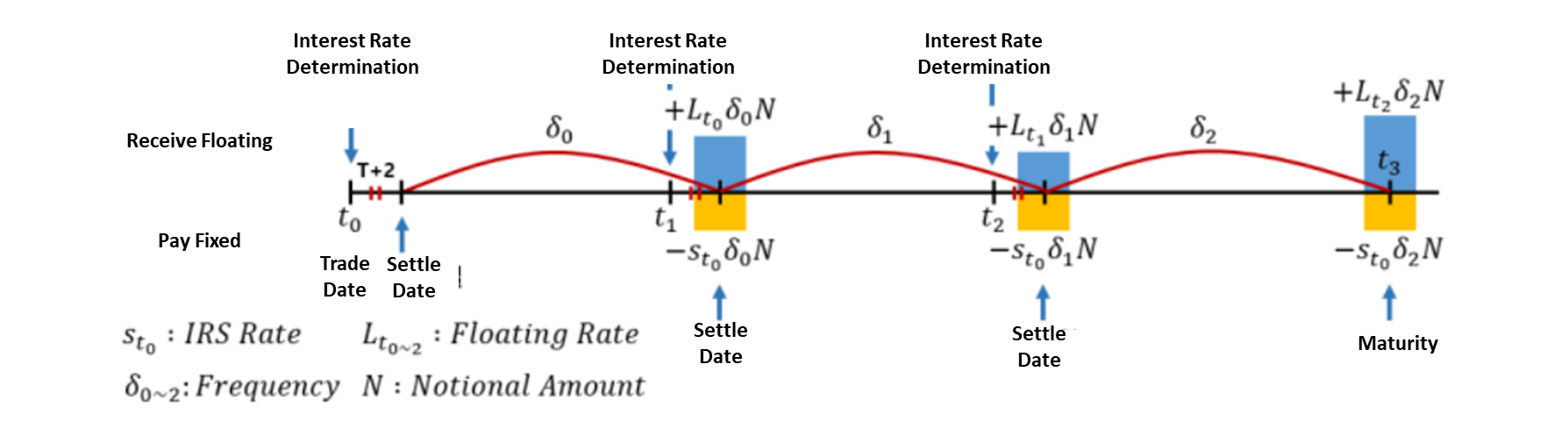

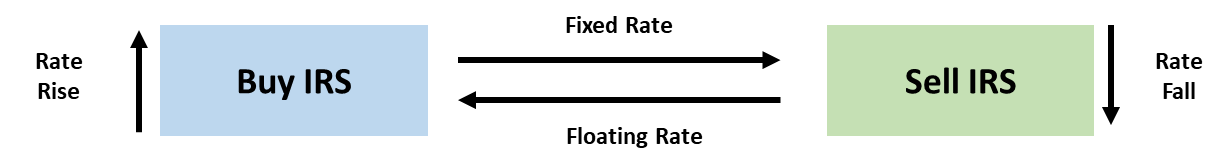

Interest rate swap is method to mitigate interest rate risk. If you buy IRS, you can pay fixed swap rate until maturity, while you receive floating rate(such as LIBOR) to counterparty.

Since, size of this contract is huge, it is mainly field of institutional players. I strongly recommend you to study this material for your future goal, becomming rich enough to trade IRS with your own capital. IRS combined with FX market makes huge impacts. Big IRS contracts sometimes impacts FX market. Suppose you are foreign bond investors (at dollar perspective), you might want to secure fixed income at your currency, then you might go to Forward market. So interest rate (bond) and fixed income is inevitable.

Buyer of interest rate swap(IRS)

Suppose you are investor of floating bond investors, you might worry about fluctuating interest rate. To mitigate this, you buy IRS. So, you receive floating interest rate and pay fixed rate(swap rate).

Seller of interest rate swap(IRS)

On contrary, If you think that interest rate will fall soon, you will sell IRS to counterparty. If rate falls as you expected, floating interest payment you need to pay to buyer will decrease.

How to understand IRS?

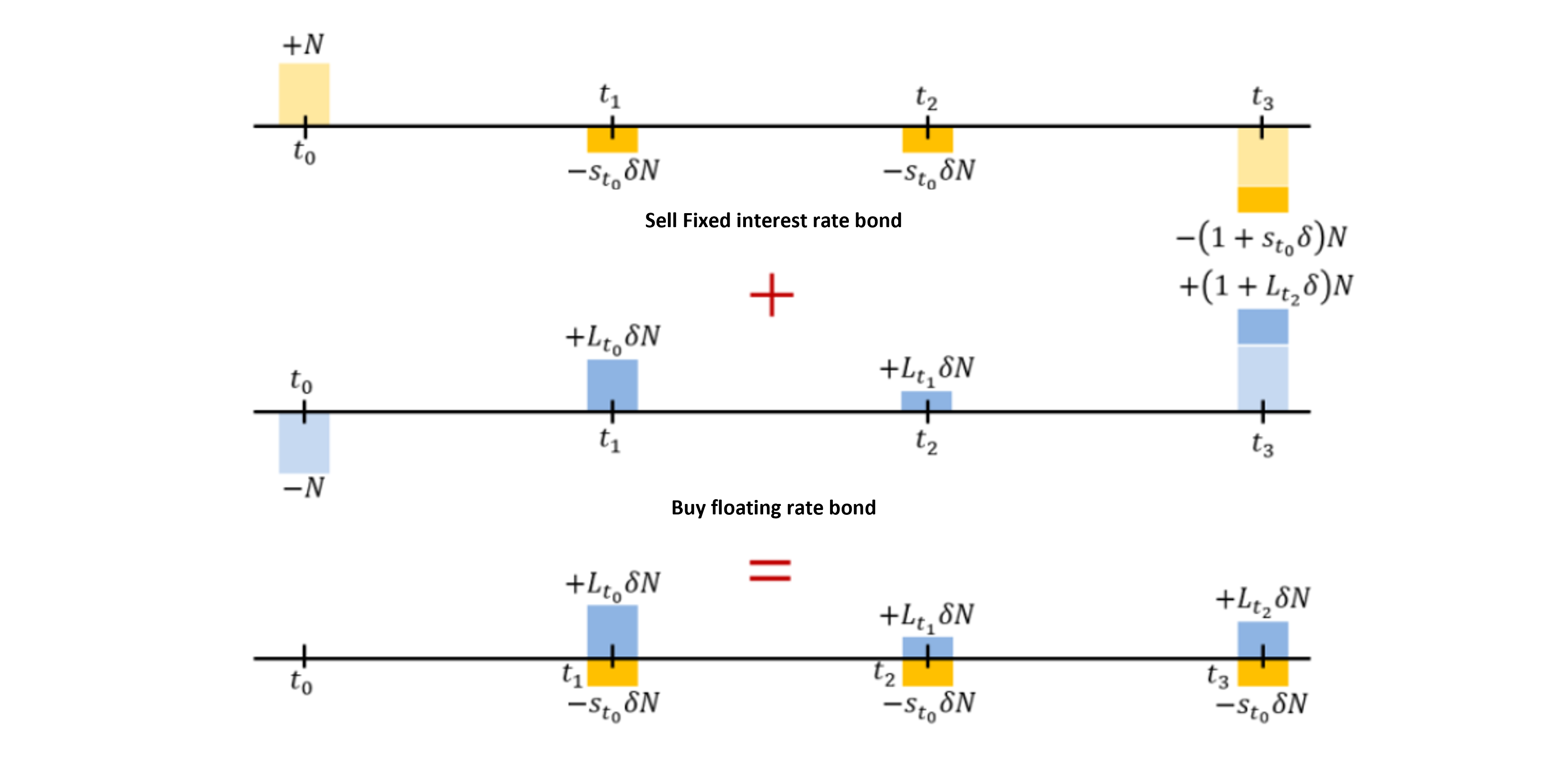

Of course, IRS might seems complicated to some of you. If you decompose IRS vertically, you can easily understand that IRS is simply sum of selling fixed interest rate bond and buying floating rate bond. So, you pay fixed and receive floating. This mitigates risk of interest rate rise. See picutre below.

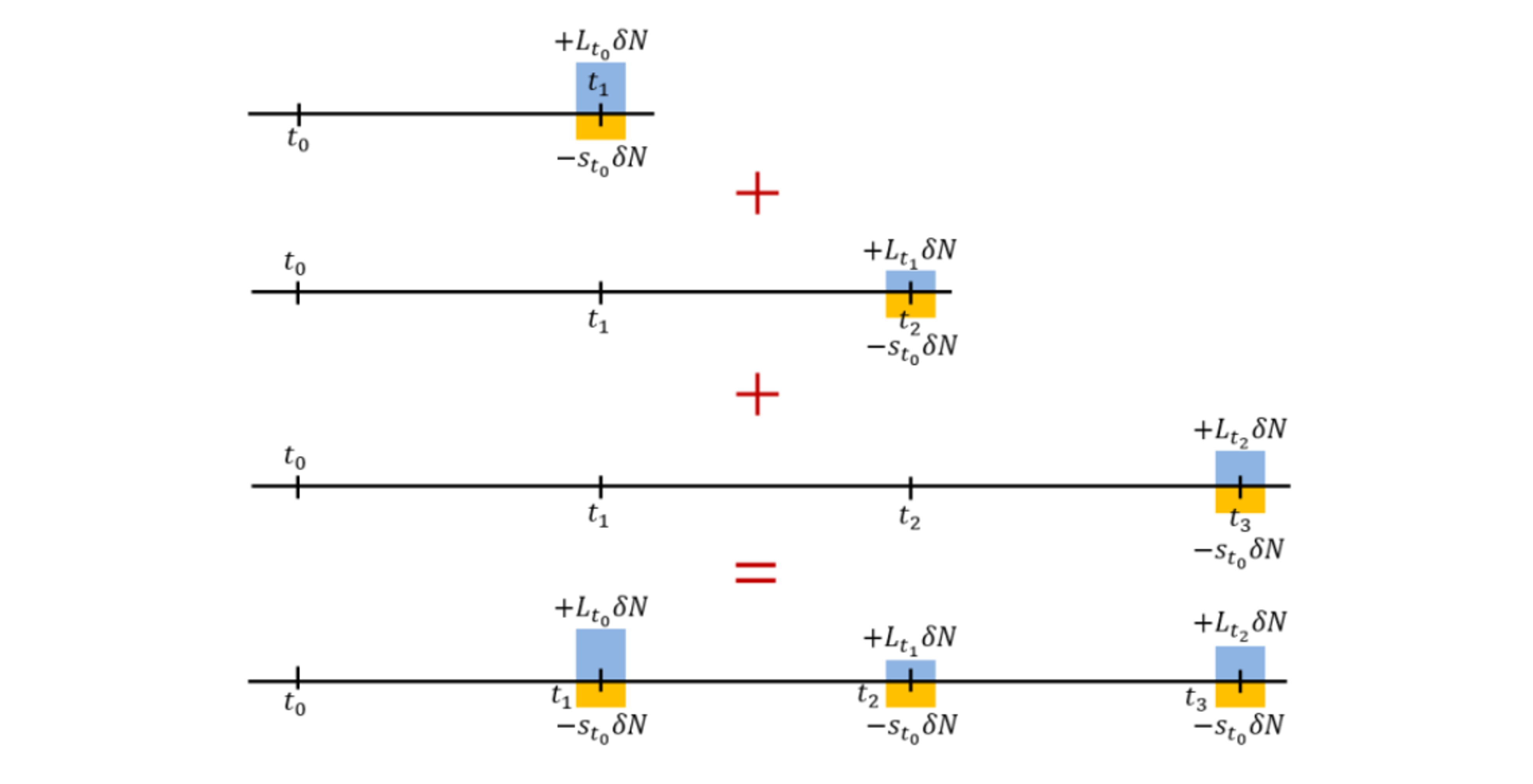

In addition, IRS can be expressed in horizontally. Cashflow of IRS is sum of combined forward rate aggrements. If we sum value of forward rate aggrement with different maturity, you can calculate value of IRS. See picture below.

Summary

See below picture, if you are facing trouble in memorizing the IRS structure.

Prequisite

1

from quant_lib.swap_curve import get_quote, swap_curve

If you don’t want to make your own swap curve library, go to this link and download and place it appripriate directory. Swap_Curve_Code Swap_Curve_Notebook

for example, let’s price IRS for buyers

1

2

3

4

5

6

7

8

9

10

11

issueDate = 10/9/2022

pricingDate = 1/9/2021

maturityDate = 4/9/2021

tenor = quarterly

swap rate = 2.18%

face value = 1000000

settlement days = first date of month

price of IRS = 16.134813731714075

delta of IRS = 25.262571390637277

theta of IRS = -2.3642255974538102

Let’s code this idea

Full code can be found at below link. CODE

Full Code

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

import os

import datetime

import numpy as np

import pandas as pd

import QuantLib as ql

from quant_lib.swap_curve import get_quote, swap_curve

class IRS():

def __init__(self, today, pricing_date, maturity_date, irs_rate, notional, position, spread=0.0):

# initial setup

self.date = today

self.curve = self.CURVE(self.date)

self.pricing_date = ql.Date(pricing_date.day, pricing_date.month, pricing_date.year)

self.maturity_date = ql.Date(maturity_date.day, maturity_date.month, maturity_date.year)

self.calendar = ql.UnitedStates()

self.convention = ql.ModifiedPreceding

self.day_counter = ql.Actual360()

self.fixed_tenor = ql.Period(1, ql.Years)

self.float_tenor = ql.Period(3, ql.Months)

self.irs_rate = irs_rate

self.notional = notional

if position == 'long':

self.position = ql.VanillaSwap.Payer

else:

self.position = ql.VanillaSwap.Receiver

self.spread = spread

# pricing result

self.npv = self.PRICING(self.curve)

self.delta = self.DELTA()

self.theta = self.THETA()

def CURVE(self, date):

return swap_curve(date, get_quote(date))

def PRICING(self, curve):

#yield term structure

curve_handle = ql.YieldTermStructureHandle(curve)

# USD 3M Libor

float_index = ql.USDLibor(ql.Period(3, ql.Months), curve_handle)

# Fixed Schedule

fixedSchedule= ql.Schedule(self.pricing_date, # effectiveDate

self.maturity_date, # terminationDate

self.fixed_tenor, # tenor

self.calendar, # calendar

self.convention, # convention

self.convention, # terminationDateConvention

ql.DateGeneration.Backward, # rule

False # endOfMonth

)

# Fixed Schedule

floatingSchedule= ql.Schedule(self.pricing_date, # effectiveDate

self.maturity_date, # terminationDate

self.float_tenor, # tenor

self.calendar, # calendar

self.convention, # convention

self.convention, # terminationDateConvention

ql.DateGeneration.Backward, # rule

False # endOfMonth

)

# Interest Rate Swap

irs = ql.VanillaSwap(self.position,

self.notional,

fixedSchedule,

self.irs_rate,

self.day_counter,

floatingSchedule,

float_index,

self.spread,

self.day_counter

)

# pricing engine

swapEngine = ql.DiscountingSwapEngine(curve_handle)

irs.setPricingEngine(swapEngine)

# IRS pricing

npv = irs.NPV()

return npv

def DELTA(self):

# delta is change in values if 1bp of interest rate curve changes

# in here we use KRD (Key Rate Delta) not DV01

# KRD means how each tenor changes

curve_handle = ql.YieldTermStructureHandle(self.curve)

basis_point = 0.0001

# irs price when 1bp up

up_curve = ql.ZeroSpreadedTermStructure(

curve_handle,

ql.QuoteHandle(ql.SimpleQuote(basis_point))

)

up_irs = self.PRICING(up_curve)

down_curve = ql.ZeroSpreadedTermStructure(

curve_handle,

ql.QuoteHandle(ql.SimpleQuote(-basis_point))

)

down_irs = self.PRICING(down_curve)

#DV01

delta = (up_irs - down_irs)/2

return delta

def THETA(self):

# theta is change in value if one unit time passes.

# in here, unit time is 1 day

# since derivative product have time value, time to maturity is major variable in pricing derivatives

price_t0 = self.PRICING(self.CURVE(self.date))

price_t1 = self.PRICING(self.CURVE(self.date + datetime.timedelta(days=1)))

return price_t1 - price_t0

## set information

todays_date = datetime.date(2020, 10, 9)

pricing_date = datetime.date(2021, 1, 9)

maturity_date = datetime.date(2021, 4, 9)

position = 'long'

irs_rate = 0.00218

notional = 1000000

irs = IRS(

today=todays_date,

pricing_date=pricing_date,

maturity_date=maturity_date,

irs_rate=irs_rate,

notional=notional,

position=position,

spread=0.0

)

print("price of IRS = {}".format(irs.npv))

print("delta of IRS = {}".format(irs.delta))

print("theta of IRS = {}".format(irs.theta))