This post is about application of kelly criterion to financial investors.

What is Kelly Criterion

Kelly Criterion was developed to assist AT&T with its long-distance telephone signal noise issues and published as “A New Interpretation of Information Rate” in 1956. However, this idea could be easily adopted to gambling field. This idea enabled gamblers to maximize the size of their bankroll over the long term. Today, many people use it as a general money management system for gambling as well as investing.

Applying this therom to multi asset classes portfolio is equivalent to mean-variance portfolio optimization process. Thus maximum sharpe ratio solution (which requires inverse of correlation matrix) is needed. Detailed derivation can be found in below link.

Mathematics for Kelly Criterim

Simple Math

Kelly began by analyzing games with a binary win-lose outcome. The key variables are:

- b: The odds define the amount won for a \$1 bet. Odds = 5/1 implies a \$5 gain if the bet wins, plus recovery of the \$1 capital.

- p: The probability defines the likelihood of a favorable outcome.

- f: The share of the current capital to bet.

- V: The value of the capital as a result of betting.

The Kelly rule aims to maximize the value’s growth rate, G, of infinitely-repeated bets.

$ G=\lim_{N\rightarrow\infty}=\frac{1}{N}\log\frac{V_N}{V_0} $

If we apply this formula to multiple assets, the result is equivalent to the (potentially levered) maximum Sharpe ratio portfolio from the mean-variance optimization. The computation involves the dot product of the precision matrix, which is the inverse of the covariance matrix, and the return matrix:

Data used (index)

I used index data from major index maker. All index are available in ETF(Exchange Traded Fund) form and can be traded easily.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

IVV : iShares Core S&P 500 ETF

VEA : Vanguard FTSE Developed Markets ETF

VWO : Vanguard FTSE Emerging Markets ETF

TLT : iShares

TIP : iShares TIPS Bond ETF

LQD : iShares iBoxx $ Investment Grade Corporate Bond ETF

DBC : Invesco DB Commodity Index Tracking Fund

XAR : SPDR® S&P® Aerospace & Defense ETF

XLB : The Materials Select Sector SPDR® Fund

XLE : The Energy Select Sector SPDR® Fund

XLF : The Financial Select Sector SPDR® Fund

XLI : The Industrial Select Sector SPDR® Fund

XLK : The Technology Select Sector SPDR® Fund

XME : SPDR® S&P® Metals & Mining ETF

XLP : The Consumer Staples Select Sector SPDR® Fund

XLY : The Consumer Discretionary Select Sector SPDR® Fund

XLU : The Utilities Select Sector SPDR® Fund

XLV : The Health Care Select Sector SPDR® Fund

XPH : SPDR® S&P® Pharmaceuticals ETF

XBI : SPDR® S&P® Biotech ETF

RWR : SPDR® Dow Jones® REIT ETF

RWX : SPDR® Dow Jones® International Real Estate ETF

Benchmark for this strategy is all weather porfolio of Ray Dalio.

1

2

3

4

5

Equity: MSCI All Country 30%

Long Fixed Income : Bloomberg US 20+ Treasury 40%

Mid-Short Fixed Income : Bloomberg US 7-10 Treasury 15%

Commodity : Gold Index 7.5%

Commodity : Goldmansachs Commodity Index 7.5%

Strategy Overview

1

2

3

4

5

6

7

8

9

10

11

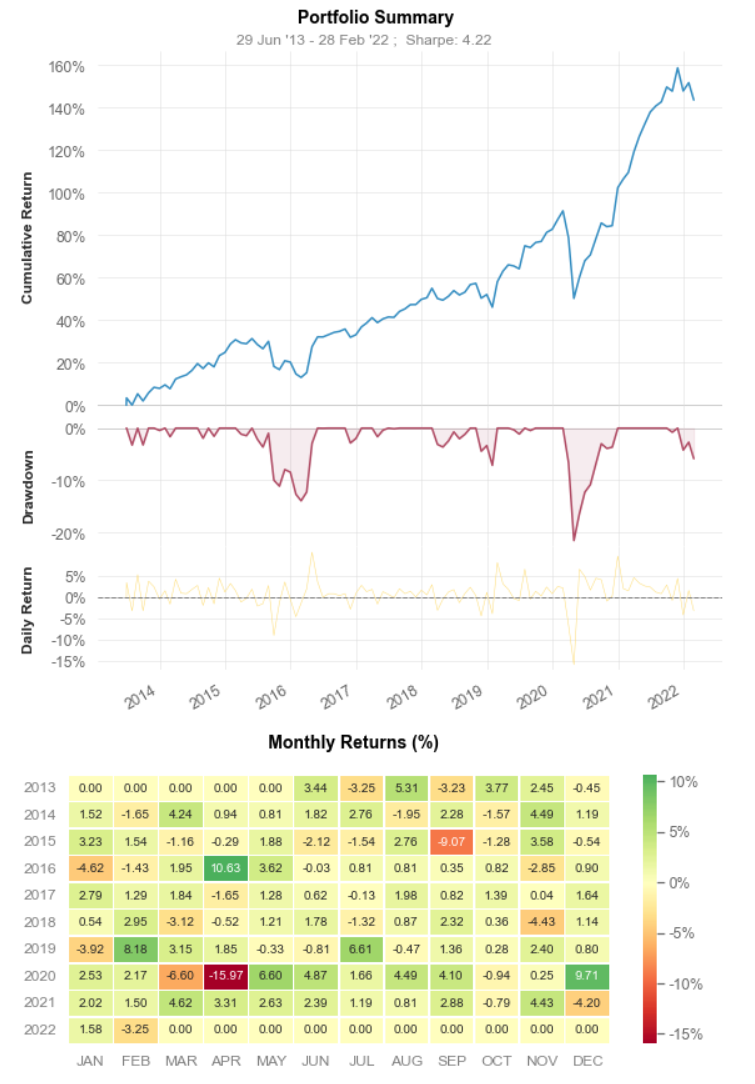

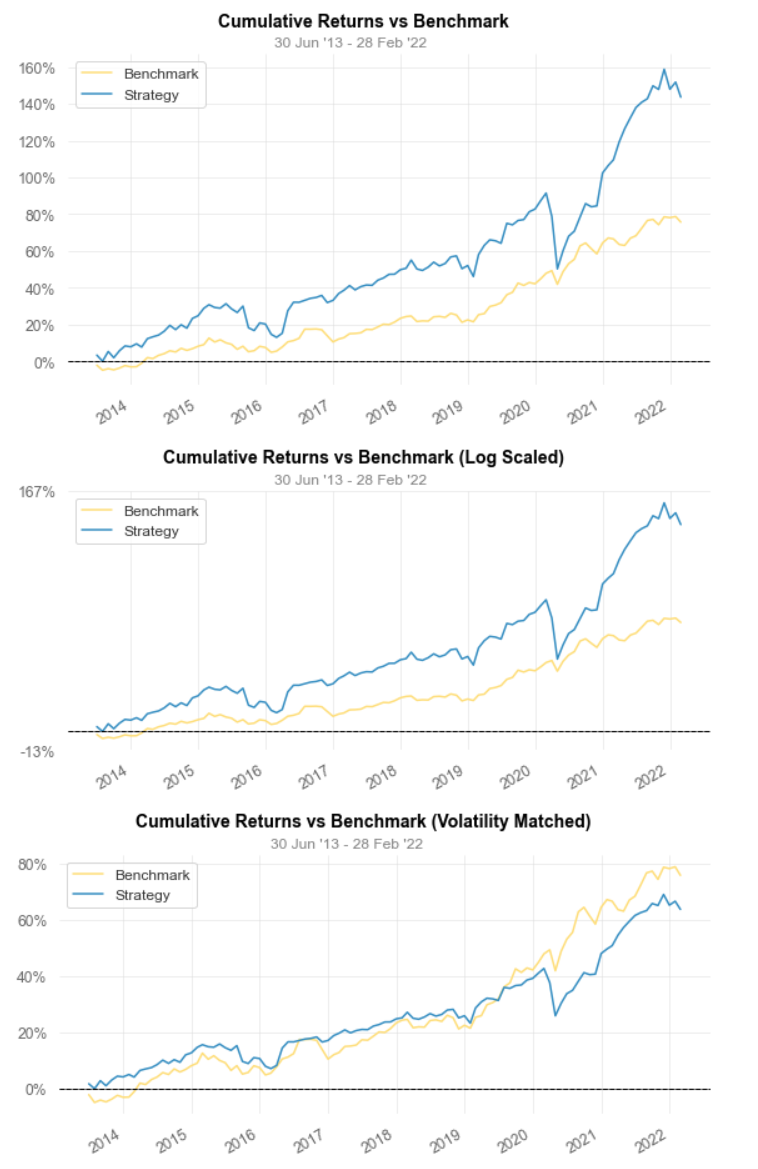

Strategy Benchmark

-------------------------- ---------- -----------

Start Period 2013-06-30 2013-06-30

End Period 2022-02-28 2022-02-28

Cumulative Return 143.67% 75.73%

CAGR﹪ 10.82% 6.72%

Sharpe 4.24 4.83

Expected Shortfall (cVaR) -4.7% -2.44%

Max Drawdown -21.52% -6.86%

Full Code

You can see full code in here CODE

Let’s code this idea

Kelly Criterion in multiple asset classes via python code.

1

2

3

4

5

6

7

8

9

10

11

12

13

def kelly_allocation_mp(asset_ylds):

cov = asset_ylds.cov()

# np.linalg.inv(cov) returns inverse matrix in numpy matrix type

precision_matrix = pd.DataFrame(np.linalg.inv(cov), index=asset_ylds.columns.tolist(), columns=asset_ylds.columns.tolist())

kelly_allocation = asset_ylds.mean().dot(precision_matrix)

# constraints : long position only, short signal will be map to zero

kelly_allocation[kelly_allocation < 0] = 0

# normalize target postion to 100

kelly_allocation = kelly_allocation.div(kelly_allocation.sum())

return kelly_allocation

Full Result

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

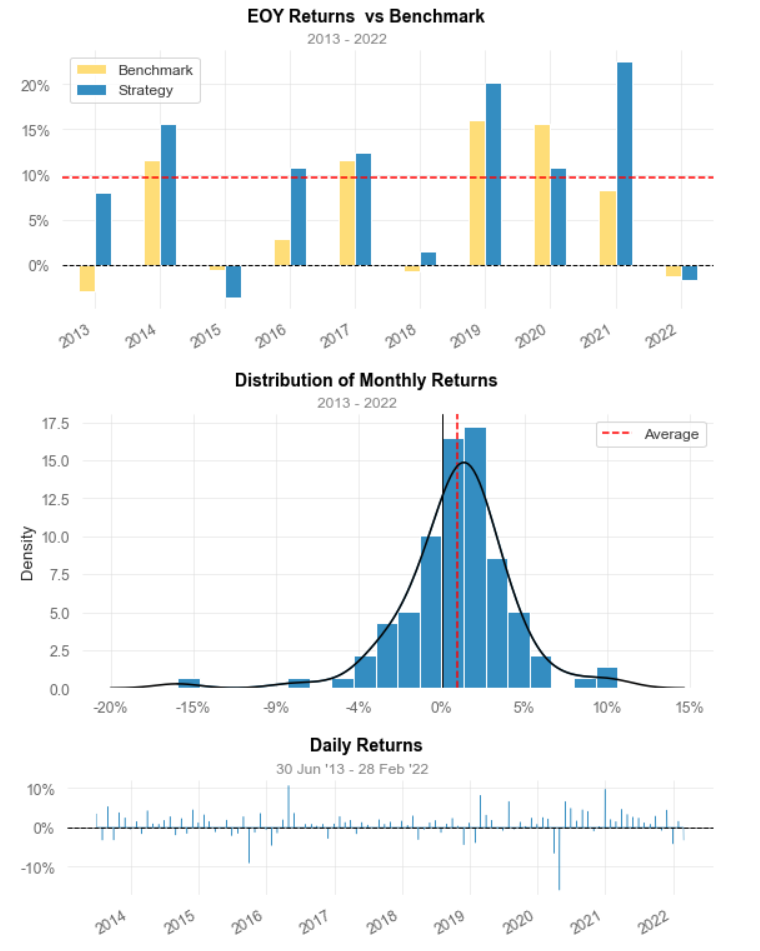

Strategy Benchmark

------------------------- ---------- -----------

Start Period 2013-06-30 2013-06-30

End Period 2022-02-28 2022-02-28

Risk-Free Rate 0.0% 0.0%

Time in Market 100.0% 100.0%

Cumulative Return 143.67% 75.73%

CAGR﹪ 10.82% 6.72%

Sharpe 4.24 4.83

Smart Sharpe 4.12 4.69

Sortino 6.41 8.36

Smart Sortino 6.23 8.12

Sortino/√2 4.54 5.91

Smart Sortino/√2 4.4 5.74

Omega 2.12 2.12

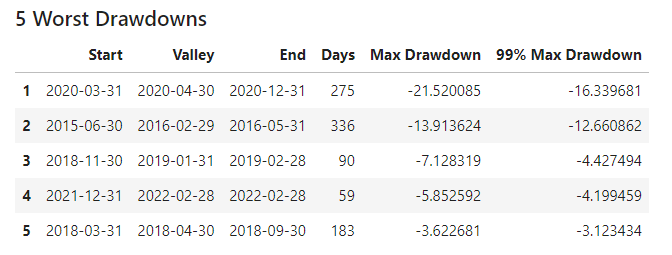

Max Drawdown -21.52% -6.86%

Longest DD Days 336 488

Volatility (ann.) 54.12% 28.94%

R^2 0.43 0.43

Calmar 0.5 0.98

Skew -1.08 -0.23

Kurtosis 6.02 0.23

Expected Daily % 0.85% 0.54%

Expected Monthly % 0.85% 0.54%

Expected Yearly % 9.32% 5.8%

Kelly Criterion 31.85% 30.27%

Risk of Ruin 0.0% 0.0%

Daily Value-at-Risk -4.7% -2.44%

Expected Shortfall (cVaR) -4.7% -2.44%

Gain/Pain Ratio 1.12 1.14

Gain/Pain (1M) 1.12 1.14

Payoff Ratio 0.86 1.02

Profit Factor 2.12 2.14

Common Sense Ratio 2.67 2.6

CPC Index 1.24 1.42

Tail Ratio 1.26 1.21

Outlier Win Ratio 2.85 4.46

Outlier Loss Ratio 2.34 4.41

MTD -3.25% -1.7%

3M -1.68% 0.82%

6M 1.16% 1.95%

YTD -1.73% -1.35%

1Y 17.99% 5.15%

3Y (ann.) 15.98% 12.26%

5Y (ann.) 12.15% 9.41%

10Y (ann.) 10.82% 6.72%

All-time (ann.) 10.82% 6.72%

Best Day 10.63% 4.86%

Worst Day -15.97% -4.97%

Best Month 10.63% 4.86%

Worst Month -15.97% -4.97%

Best Year 22.48% 16.01%

Worst Year -3.64% -2.96%

Avg. Drawdown -3.82% -2.24%

Avg. Drawdown Days 79 106

Recovery Factor 6.68 11.03

Ulcer Index 0.05 0.02

Serenity Index 11.85 14.34

Avg. Up Month 2.82% 1.78%

Avg. Down Month -3.29% -1.74%

Win Days % 68.57% 64.76%

Win Month % 68.57% 64.76%

Win Quarter % 72.22% 72.22%

Win Year % 80.0% 60.0%

Beta 1.23 -

Alpha 0.58 -

Strategy Evaluation

To be updated …