This post is about rate curve of treasury market. Data will be scaped from wsj site and quantlib library will be used.

What is Discount rate in finance?

One of the most important role of quant is to price financial products. In main street, cost which are shown in accounting report is one of the most important factor for pricing products they are selling. However, cost in financial product is ambigous. Recall finance 101, you might learned about Time Value of Money(TVM). TVM can be found at BA2-plus calculator. In here, we discount future cash flow, value to present value.

When we calculate PV, we multiply future CF with discount rate. Recall finance 101, when you calculate this, discount rate was given in your question. However, in real world what is that number? Answer to this question is interest rate which can be found at bond market. Just like stock market (NYSE, NASDAQ), bond markets are continous and make real-time number. You can use that number to price your financial product.

Why do we need curve?

Some might wonder, why we need curve instead of bond yield which can be shown at bloomberg terminal or yahoo finance. Answer to this question is the concept of “continous compounding”. Bond yield you can get from market is discret. Please click below link.

DATA

If you clik above url, you can go to Wall Street Journal market data page. Only bond yield you can get at bond tab are 1-month, 3-month, 6-month, 1-year, 2-years, 3-years, 5-years, 7-years, 10-years, 30-years.

If you want to price bond which has maturity of 12 years, what number you would use? Hmm…. Very difficult. You can clearly say 10-years, 30-years maturity bond yields. But 12 years maturity bond yield is difficult to answer. In here, the most optimal approach to this situation is approximation. Use piexewise informations, you can draw lines connecting dots and approximate 12 years maturity bond’s yield.

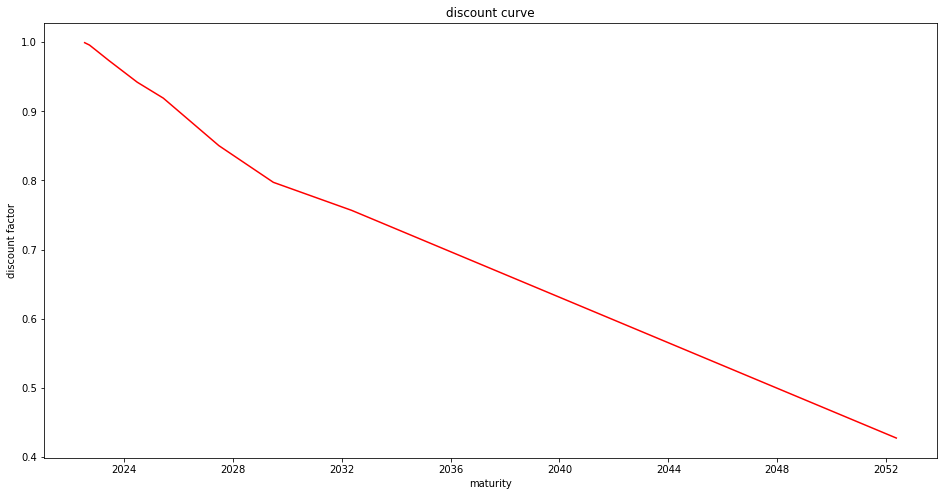

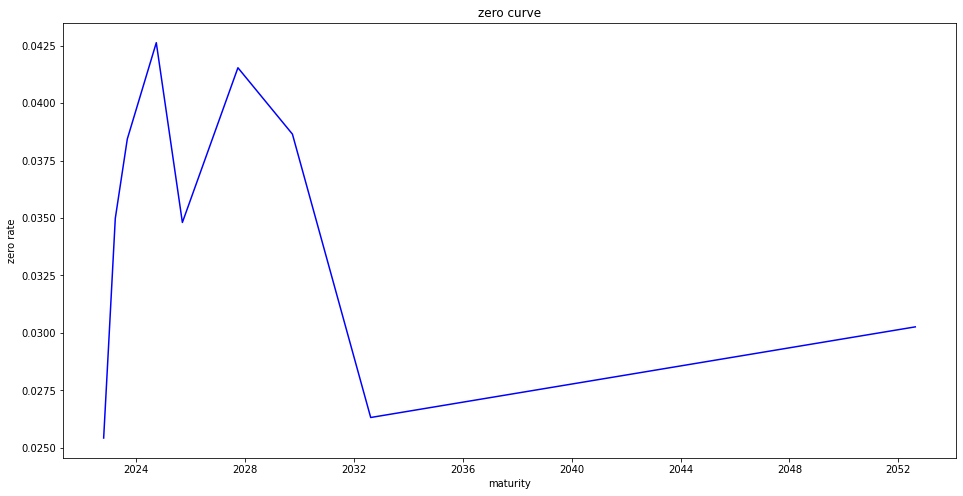

Inverted discount curve

Initial post is written at Oct, 2022. These days, yield curve is inverted. Interest rate for long maturity bond is lower than interest rate for short maturity bond. This phenomenon is uncommon. It only happens when macro economy is at severe recession and all people reluctant to invest money. So this can be signal for comming recession. If rate curve are back to normal, I will update this part.

Result with real market data

1

2

3

4

5

6

7

8

9

10

11

12

days price coupon discount factor zero rate

maturity

2022-10-25 27 2.53 0.0 0.998133 0.025425

2022-12-29 92 3.301 0.0 0.992677 0.029375

2023-03-30 183 3.914 0.0 0.982763 0.034982

2023-09-07 344 3.803 0.0 0.964756 0.038435

2024-09-30 733 4.204 4.25 0.918859 0.042629

2025-09-15 1083 4.216 3.5 0.902767 0.034806

2027-09-30 1828 4.013 4.125 0.814004 0.041538

2029-09-30 2559 3.911 3.875 0.764772 0.038650

2032-08-15 3609 3.773 2.75 0.772329 0.026319

2052-08-15 10914 3.707 3.0 0.407590 0.030263

Getting bond data

You can get bond market data from Wall Street Journal. If you use python, you can use BeautifulSoup library to scrap data.

Scrap data from WSJ

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

import numpy as np

import pandas as pd

import datetime

import requests

from bs4 import BeautifulSoup

def get_quote(reference_date):

tenors = ['01M', '03M', '06M', '01Y', '02Y', '03Y','05Y','07Y','10Y','30Y']

# create empty lists

maturities = []

days = []

prices = []

coupons = []

headers = {'User-Agent': 'Mozilla/5.0'}

# get market informations

for i, tenor in enumerate(tenors):

url = "https://www.wsj.com/market-data/quotes/bond/BX/TMUBMUSD"+tenor+"?mod=md_bond_overview_quote"

req = requests.get(url, headers=headers)

html = req.text

soup = BeautifulSoup(html, 'html.parser')

# Price

data_src = soup.find("span", id="quote_val")

price = data_src.text

price = float(price[:-1])

data_src2 = soup.find_all("span", class_="data_data")

# Coupon

coupon = data_src2[2].text

if coupon != '':

coupon = float(coupon[:-1])

else:

coupon = 0.0

# Maturity Date

maturity = data_src2[3].text

maturity = datetime.datetime.strptime(maturity, '%m/%d/%y').date()

# Send to lists

days.append((maturity - reference_date).days)

prices.append(price)

coupons.append(coupon)

maturities.append(maturity)

# create dataframe

df = pd.DataFrame([maturities, days, prices, coupons]).transpose()

headers = ['maturity', 'days', 'price', 'coupon']

df.columns = headers

df.set_index('maturity', inplace=True)

return df

ref_date = get_date()

quote = get_quote(ref_date)

print(quote)

Let’s code this idea

Full code can be found at below link. CODE

Full Code

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

def treasury_curve(date, quote):

# Divide Quotes

tbill = quote[0:4]

tbond = quote[4:]

# Set Evaluation Date

eval_date = ql.Date(date.day, date.month, date.year)

ql.Settings.instance().evaluationDate = eval_date

# Set Market Conventions

calendar = ql.UnitedStates()

convention = ql.ModifiedFollowing

day_counter = ql.ActualActual()

end_of_month = False

fixing_days = 1

face_amount = 100

coupon_frequency = ql.Period(ql.Semiannual)

# Construct Treasury Bill Helpers

bill_helpers = [ql.DepositRateHelper(ql.QuoteHandle(ql.SimpleQuote(r/100.0)),

ql.Period(m, ql.Days),

fixing_days,

calendar,

convention,

end_of_month,

day_counter)

for r, m in zip(tbill['price'], tbill['days'])]

# Construct Treasury Bond Helpers

bond_helpers = []

for p, c, m in zip(tbond['price'], tbond['coupon'], tbond['days']):

termination_date = eval_date + ql.Period(m, ql.Days)

schedule = ql.Schedule(eval_date,

termination_date,

coupon_frequency,

calendar,

convention,

convention,

ql.DateGeneration.Backward,

end_of_month)

bond_helper = ql.FixedRateBondHelper(ql.QuoteHandle(ql.SimpleQuote(100)),

fixing_days,

face_amount,

schedule,

[c/100.0],

day_counter,

convention)

bond_helpers.append(bond_helper)

# Bind Helpers

rate_helper = bill_helpers + bond_helpers

# Build Curve

yc_linearzero = ql.PiecewiseLinearZero(eval_date, rate_helper, day_counter)

return yc_linearzero

def discount_factor(date, curve):

# returns discount factors of each day

# use quantlib date type

print(date)

date = ql.Date(date.day, date.month, date.year)

return curve.discount(date)

def zero_rate(date, curve):

date = ql.Date(date.day, date.month, date.year)

day_counter = ql.ActualActual()

compounding = ql.Compounded

freq = ql.Continuous

zero_rate = curve.zeroRate(date, day_counter, compounding, freq).rate()

return zero_rate